-

(818) 833-8737

13521 Hubbard St.Sylmar, CA 91342

- Login

Tax Relief/ Extensions - All LA County due to LA Fires

Posted on 01/14/2025

In response to the unprecedented and devastating fires impacting our community, federal, state, and local tax agencies have announced tax relief including postponing various tax filing and payment deadlines for Los Angeles County.

IRS Announces Federal Tax Relief – Deadline Extension

Individuals and businesses whose permanent address of record is anywhere in Los Angeles County, regardless of whether the individual or business was directly impacted by recent wildfires, will qualify for IRS deadline extension relief and automatically receive extra time from the IRS to file returns and pay taxes. Taxpayers will not be penalized nor will interest accrue on tax payments during this time. Taxpayers do not need to call or write to receive disaster tax relief from the IRS.

Taxpayers will now have until October 15, 2025 to file their tax returns. January 15th, April 15th, June 16th, and September 15th quarterly income tax payment deadlines have also been extended to October 15, 2024.

For businesses – annual tax returns and payments have also been extended until October 15, 2025. Furthermore, quarterly payroll and excise tax returns normally due on January 31st, April 30th, and July 31st have been extended to October 15, 2025 as well.

Businesses will not be penalized nor will interest accrue on tax payments during this time.

For additional information –

Additional Information Provided by the IRS can be found at the following:

IRS's Disaster Assistance Page provides updates and links to resources -

IRS Toll-Free Disaster Assistance Hotline at: 866-562-5227

Franchise Tax Board Announces State Tax Relief

The California Franchise Tax Board has extended the deadline to file California tax returns and to pay any tax payments for individuals and businesses anywhere in Los Angeles County to October 15, 2025. Taxpayers do not need to call or write to receive disaster tax relief from the California Franchise Tax Board.

For Additional Information –

Los Angeles County Property Assessor Announces Property Tax Relief

The Los Angeles County Assessor’s Office has announced property tax relief for those in Los Angeles County whose property has been damaged or destroyed due to the ongoing wildfires.

If your property has been damaged or destroyed or its value is in any other way less than it was on January 1, you may file an application for a Decline-in-Value-Review. The filing period is from July 2 through November 30.

If your property has been damaged or destroyed by the fire, and the loss exceeds $10,000 in value, you may qualify for reassessment.

For more information, including how to apply –

See you in January

Sign-Up • Receive Agendas

Upcoming Meetings & Events

-

Dec17

Cancelled

Equestrian Committee Meeting - Dec17 Free Produce/Food Distribution at Olive View/UCLA Medical Center 9:30am - 11:30am

- Dec18 FREE MOVIE NIGHT AT THE SNC Council Office

- Dec22 Free Produce/Food Distribution at Olive View/UCLA Medical Center 9:30am - 11:30am

- Dec22 Telescope Nights at Sylmar Library

Sylmar Community Calendar

MyLA311

My LA 311

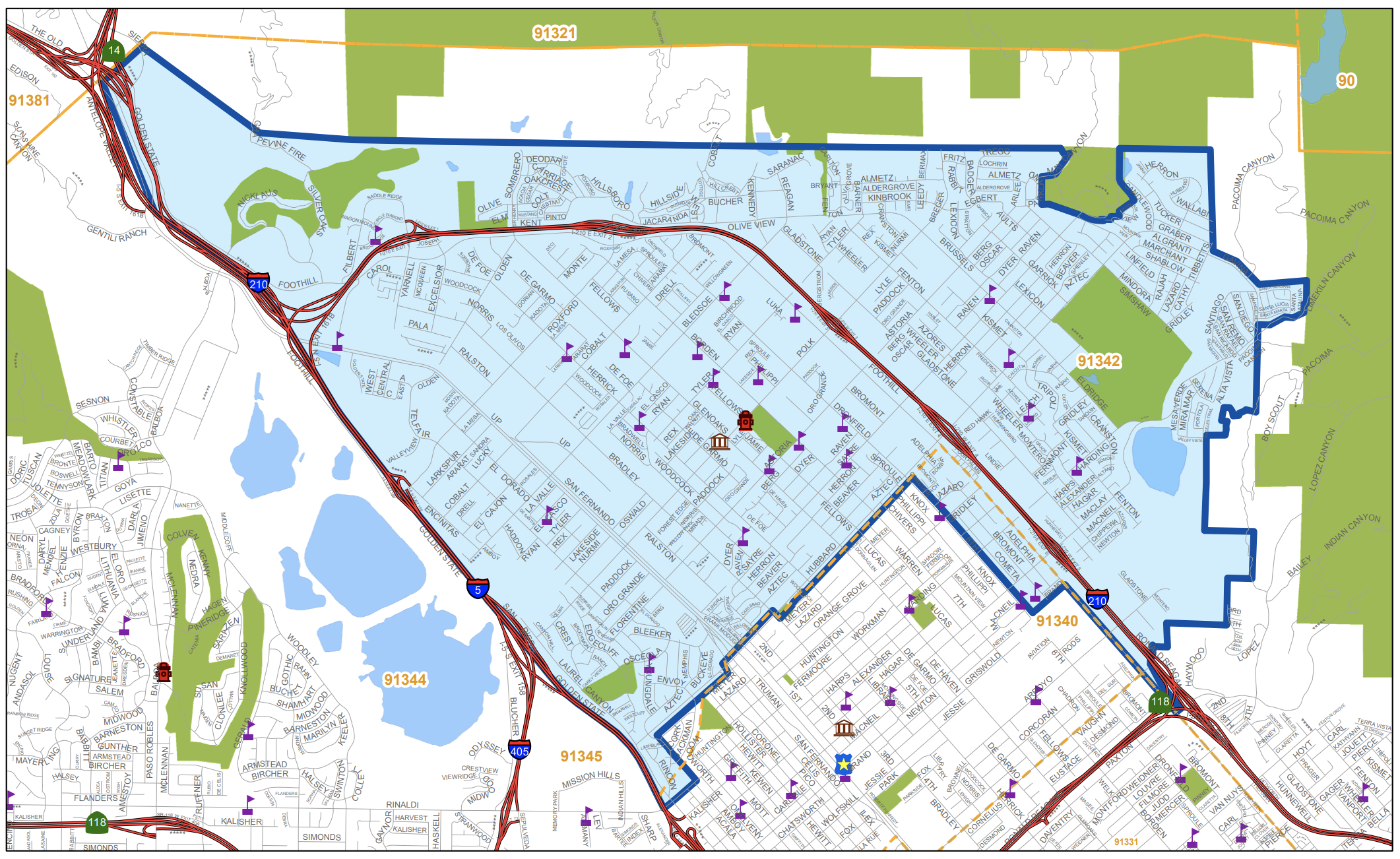

Area Boundaries and Map

View our neighborhood council boundaries for which we deal with.

EMPOWER LA

NEIGHBORHOOD COUNCIL CALENDAR & EVENTS

The public is invited to attend all meetings.

NEIGHBORHOOD COUNCIL FUNDING SYSTEM DASHBOARD

SUBSCRIBE TO NC MEETING NOTIFICATION